Thanks for stopping by - This is a work in progress, so please feel free to jump in with me - any comments, feedback, or participation in the conversation is encouraged! You might want to want to sign up for email updates on the right, or subscribe to my RSS feed. Thanks for visiting!

Glad to have you back - have you considered signing up for email updates on the right, or subscribing to my RSS feed? Thanks for visiting!

One way you can drive yourself crazy trying to get the best deal you can on a mortgage is to obsess over comparing interest rates. Don’t get me wrong – we’re usually talking about a 30 year expense here, and the rate and general loan pricing is a critical component of effective, financially responsible, home ownership.

But you can take it too far by trying to nail the market at it’s absolute best level, and you can also disrupt the process by idling for too long in shopping mode.

Luckily, there are a few general guides you can stick to in order to maximize your outcome, and avoid shooting yourself in the foot.

Rates changed 36 times during the 21 bond trading days in April.

That can really make it a pain in the neck to figure out what the best rate is going to be when you’re in the middle of buying or refinancing a home. You call one lender first thing in the morning, email two others at lunch, one of whom doesn’t reply until the end of the day, and by the time you have all your research, you’re looking at three different ‘vintages’ of rate quote. Can a fair comparison be made?

Maybe.

But you’ll need to know first if rates have changed over the course of the day. And based on recent history, odds are you’ll be comparing apples and papayas. Besides, even if you can get three quotes in the same window, how do you know if today is better than tomorrow?

When it comes to mortgage quotes, the little differences can be meaningful. If you want to maximize your shopping results, you need to make sure you are comparing quotes from the same vintage, and you need to know what vintage is produced in the best climate.

Rates changed every 4.12 hours in April

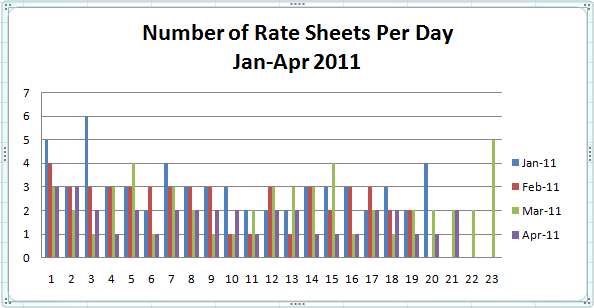

In April there were 21 bond trading days. We received 36 rate sheets over those 21 days, or an average 1.71 rate sheets per day.

Most lenders have open lock desks for 8 hours a day. Some are open for 9, and the most aggressive lenders, often the most sensitive to bond market fluctuation, accept rate locks for about 6 or 6 1/2 hours a day. On turbulent bond market days, they often delay the first rate sheet release.

Assuming an average of 7 hours for an open lock desk, and 1.71 rate sheets per day, that means rates changed every 4.12 hours. Compared to January’s average expiration of 2.29 hours, the volatility has been cut nearly in half over the past few months.

Intra-day Volatility is Only Part of the Picture

The trend toward lower volatility compared to prior months can be seen in several ways. The most changes in a single day was 3, which happened only twice. We had more calm days; there were 8 days with one rate issue, up from 6 in March, 3 in February, and none in January.

Lower volatility is a good thing. It takes some anxiety out of the process for working through a purchase or refinance transaction, and it also tends to help reduce defensive pricing by lenders, giving them greater confidence to be aggressive.

But volatility only provides part of the picture. During the month of April, mortgage rates traveled quite a range, ending significantly lower than both where they began, and also the highest mark set on April 8. If you were in escrow looking to lock your rate, you’d not only want to know about vintages for comparing quotes, but when in the month would be the best time to lock no matter where you do it.

How to Make the Most of it

Last month, rates changed 36 times on 21 bond trading days. If a typical escrow period when you’re buying a new home is 30 days, that means you had a 1 in 36 chance to nail it on your rate lock. If you’re applying for a mortgage, it’s a virtual certainty that you already have a full time job, so you really should rely on a professional with the time and insight to be able to monitor this for you.

If you speak to someone who suggests they can get you the perfect lock, that’s probably a bad sign. Market prediction on that level is impossible. Similarly, you shouldn’t expect to catch the market at it’s absolute low – it’s not a realistic expectation. But a professional who can explain the market context you’re transacting in, and show you which calendared events have potential to introduce greater risk or opportunity to your strategy, is probably more valuable as a resource than anything else when trying to maximize your rate lock.

Make sure you get your rate quotes in the same vintage. This means that any lender who isn’t quick to reply to your inquiry isn’t really helping out. Then, make sure your lender is tuned in to the economic calendar, so that you can be aware of what days are more or less likely to be volatile ones. The market gets little economic data snacks to munch on every day. It’s critical to know which ones are bigger, might cause indigestion, induce vomiting, etc. The last thing you want to do is leave your rate lock open when the risk is greater than the potential reward.

Working with your lender to create a lock and pricing strategy suitable for your transaction will probably shed some light on who you’re working with, and serve you far better in the long run than comparing apples and papayas.

Need help with a rate lock strategy? Contact me below and tell me how I can help.