You’re probably somewhat tired of hearing about the “all-time historical lows in mortgage rates”. Especially if you’re in the ‘mortgage hurt locker’ – trapped in an outdated (high) mortgage rate where if you want to refinance you’re required to make a whole new down payment just to get your loan balance in line with your new (lower) property value. That’s just adding insult to injury, and I talk to people in that situation every day. So I get it. The radio blasts claiming “the biggest no-brainer in the history of mankind” are just plain obnoxious.

I mean, this is my business, and I’m tired of hearing about it. I love that it’s true, but I’m tired of the over-broadcasting.

Mortgage Rates About To Start With A Three?

So, I kind of hate to break it to you, you’re about to hear it all over again. That said, I probably don’t need to explain why this could be a great thing for you, do I?

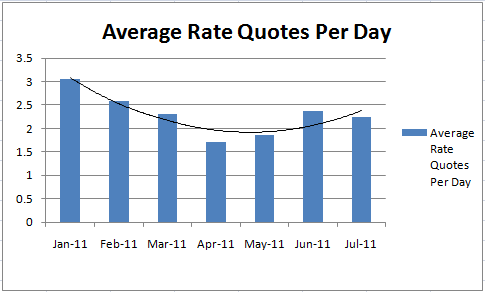

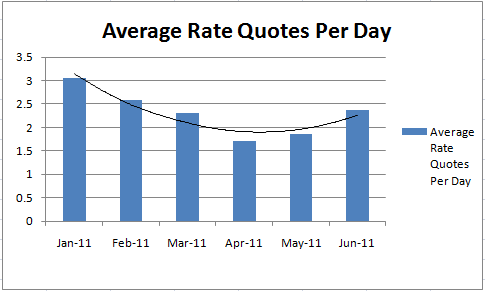

I watch the mortgage bond trading data on a daily basis. Reading and interpreting the mood of the markets is a bit of an obsession of mine. The markets move fast, and usually when the news about ‘record lows’ is hitting the press, the market has already offered those low rates, briefly, and then bounced back higher. In fact, there are small changes to mortgage rates for any given borrower scenario just about every day. I think the most changes I’ve seen in a day is six.

And Then There Are Seismic Shifts

Before mortgage rates can fall, mortgage bond values need to increase. In recent weeks, the bond values had bounced several times against the same level, causing rates for mortgages to similarly skip off these ‘historical low’ points, with rhythmic increases in between each bounce. Today, the ceiling was broken, and bond values soared into a new range. Lenders don’t often bring their rates down as instantly, for reasons too complex to go into here. But if this move sticks, the new water cooler conversation in the office is going to be about Lumberg’s new Three-point-something 30 year fixed.

We had one of these shifts when the Fed announced they’d be buying Mortgage Bonds in Nov 2008 and again when they essentially doubled-down and committed a new budget for Mortgage Bonds in August 2010.

So What is it This Time? … What’s Operation Twist?

Yesterday the Federal Reserve announced details of the awaited “Operation Twist”, which is a new Open Market activity designed basically to compress borrowing costs. It appears to be almost specifically targeted in the mortgage/housing sector. The “twist” part refers to the idea that the Fed will be converting existing capital versus deploying new capital (so-called Quantitative Easing) but affecting prices and rates without expanding their balance sheet… That’s all probably more technical than we need to worry about. If you want the details, read more about Operation Twist here.

Remember those $300 one-time stimulus checks we got a few years ago? The idea behind an effort like Operation Twist is that if the Federal Reserve can press mortgage rates lower, across the board, then millions of Americans can knock off $50, $100, $300, maybe $500 off their existing mortgage payments … per month… for 30 years. That’s quite a bit more meaningful than a one-time check that might barely cover your cable bill and a tank of gas.

It serves to put spending money in people’s pockets, and extend the survival time for all those people who are hanging on by a thread trying to keep up with mortgage payments in this miserable job environment.

With the direction of rates, and this new low water mark, you simply have got to review your options. There is no black or white answer, each case has unique circumstances, and a unique cost/benefit proposition. But with a backdrop of mortgage rates starting with 3 – for the first time ever – your options should be looking pretty good here.

Contact me by filling in the form below if you’d like to schedule a review. All we’ll do is identify the opportunities you have, and quantify the cost of each – including doing nothing at all.