What’s That? You’ve Always Wondered What It Would Be Like To Have Emerged From An Egg?

Well you’re in luck, pal. Some chap in Beijing has decided to build himself – and live in – an egg.

More to the point, a house that is shaped like an egg. And to be honest, it kind of looks like about as much living space as say, a baby chicken might have, just before hatching. Yowsa!

But a few things about this are fascinating to me:

- This is a clever, creative solution to the problem that many people have – access to affordable and/or ecological housing.

- The design elements are incredible – it looks pretty darn cozy in there! Not sure it has plumbing, but it beats the heck out of sleeping under a freeway overpass.

- Imagine being born anew each and every day, emerging from an egg. Ok – that’s a stretch. But still…

Truly outside the box housing.

The photos and story came from:

Beijing’s incredible, inedible egg house

Matt Hickman

Mother Naure Network Dec 14 2010

http://www.mnn.com/your-home/green-building-remodeling/blogs/beijings-incredible-inedible-egg-house

Economists Give Each Other Wet Blankets For Christmas

Even though I’m no economist, my brain is definitely wired that way. But sometimes the drab, dry, robotic formula-crunching path to every decision about every choice you have to make is a real buzzkill.

Take the Christmas holiday, and the associated tradition of gift giving for example. This week, three like-minded stories came into view, all very interesting, and each picking apart the economics of gift-giving to the extent that a sympathetic ear would be ready to just give up and quit.

Bah. Humbug!

Here’s a link to and description of each piece from the “boo-hiss” crowd:

- Ric Edelman – Teaches you how to keep your Christmas shopping budget under control. I love Ric, and it’s his job to teach consumers to be smarter about their money. I get it. But people need to have a little fun too. While he’s charismatic for a money & numbers guy, he’s admittedly not where you go to get advice on fun ways to burn through cash. Fine. But … brrr you wouldn’t have a more frigid Christmas if you ran out of firewood last week.

- WePay infographic on Mashable.com I don’t know WePay. I gather they’re an outfit that aims to teach you how to be smart with your money. Cool, fine. I really like this view of the gift “Missgivings” – they really do hit on several aspects of the holiday gift frenzy that generally get people to that Scroogy disposition. Very economic. Looking at opportunity costs, and beyond. There’s a lot of waste – your time, your money, the crowds at the stores, and the odds that you find a gift for somebody who would pay the same amount for that item – slim to none, right? Fine. But BORING!

- Joel Waldfogel & the Planet Money team on NPR – devise a very clever experiment to address the situation the WePay infographic illustrates so well. It’s actually quite amazing what happens. You should listen. Waldfogel is author of Scroogenomics: Why You Shouldn’t Buy Presents For The Holidays. I have not read it, but it does sound pretty interesting (it’s that econ brain wiring, sorry). Bottom line, go ahead it if you’re looking to make excuses for not giving loved ones gifts. Booo!

The problem is, as much as I get the logic, I hate it. Gift giving is a sport I enjoy, and as much as I love to receive gifts (email me for my address, ha!) I truly prefer to give them (In this regard, I fancy myself a lot more Jack Donaghy than Liz Lemon). But only when there’s a good reason, and a good gift to match the person. Not a forced, have-to-dont-really-wanna-but-its-a-holiday thing. That’s weak.

My recipe for success with gift-giving:

- Do your Christmas shopping all year. Keep mindful of people you care about, and you’ll stumble into great things that will be fun to give as gifts. Or, the reverse: Stumble into something you think is cool, and think about who would appreciate it the most.

- Buy it, or bookmark it. A true economist would never pay early for something they didn’t need until later (see time value of money). And a true miser would scour the internet for every possible discount or free shipping code (takes one to know one). Whatever floats your boat. But this way you’re not left scratching your head, elevating your heart rate, or worse – not giving gifts to people on Christmas.

- That whole crowded mall in mid-December thing takes on a whole different appeal if you can go and just walk around with a big wool jacket and a hot peppermint mocha. No shopping, just soaking it in, watching people ice skate, listening to the Vince Guaraldi tunes leaking out from the department stores, or playing in the square, whatever whatever. This is how you consume the season. Trust me.

This way, you don’t waste, you don’t give crappy gifts, and you don’t freak out at the malls and ruin the spirit of the season. Plus, if you actually pay for gifts a little here and a little there, you’re not going to have a credit card hangover in January…

… wishing you a merry Christmas

15 Tips To Avoid Being Madoff’ed

A recent post from Bary Ritholtz about 10 Lessons of Madoff’s Ponzi Scheme reminded me of a fairly recent presentation made by Ken Fisher at The Commonwealth Club, called How To Smell a Rat: The Five Signs Of Financial Fraud.

In actuality, there’s overlap between the two lists. But Barry’s post is a digest, and Fisher’s presentation runs an hour long, and gives a lot of great context. Good general advice for being smart with your money.

The FDIC also has a consumer advisory page about detecting scams.

Bond Market Analysts Finally Rolling Over As Rates Continue To Run Higher

photo © 2010 Tedd Santana | more info (via: Wylio)Mortgage rates in the Bay Area and elsewhere have been on a pretty wild run higher over the last several weeks. We’ve seen a few big jumps happen all in a string, not something we see too often without some corrections along the way.

That this has happened in the face of an economy that continues to struggle in general, and with unemployment and deflation concerns and no clear path to recovery, has kept many of the mortgage market analysts and commentators adequately confused as well.

It’s been like watching a kid on the beach running away from a wave as it rolls up on shore, and finally getting their feet wet. Or in this case, maybe the wave kind of overcame them and knocked them down, got them soaked. And just before being dragged out to sea, the commentary from the analysts has changed in the last day or two from one that was generally defiant, to surrender.

I mean no disrespect here. I know that nobody is capable of predicting the markets. But I look for a variety of opinions, because that gives perspective on the events that impact markets as they unfold, and helps frame conversations for me with my clients. Thats why there are people getting paid to analyze and forecast. And that’s why I read, watch and listen. Ever since Quantitative Easing II was announced by The Federal Reserve, the bond market has been retreating, and the analyst consensus has been pretty heavily oriented toward disbelief, and an expectation that it would come back around most, if not all the way. After all, that was the whole point behind QEII.

Then on Monday, two days ago, we got the first day of what looked like a correction, to bring the rising rate trend to a halt, maybe send it back the other way. It was triggered by an episode of 60 Minutes, where Fed Chairman Ben Bernanke reiterated that he believes our economy is fragile, and stated that he expected unemployment to be elevated for several (4-5) more years. This gave all the collectively defiant analysis the reinforcement it thought it needed to once again remind that this too shall pass.

Until yesterday. The consensus changed quickly. Triggered by tax cut extensions and unemployment benefit extensions, which happened over night. Look at some of the snippets I’ve gathered over the last two days:

Yesterday: The equity market is rallying and the bond market getting hit; that the deficit will increase by $700B is a death knell in the bond and mortgage markets for lower interest rates, in the minds of many it clearly shows that Washington is still paying only lip service to deficit reduction. That is the knee jerk reaction and in an already bearish rate market it doesn’t take much to add selling of fixed income investments. <$700B being a reference to the expected shortfall to the US Treasury due to tax cut extensions…>

Today: Very unusual that there seems to be no one stepping up to try and put some reasoning behind the spike in rates. It is as if it is happening with shock and awe, no consensus or any particular explanation.

Yesterday: With the way the market is reacting to goods news compared to bad news, I would suggest if you are not already doing this, to lock when your deal is approved until this madness stops. Changing advice from float to lock.

Today: Lock (no comments)

Yesterday: Not sure current level of support is strong enough and if we dont hold, we will fall hard in search of new lows. Ouch.

Today: We are in a free fall until bottom can be found

As I was writing this, the bond market seemed to have hit a bottom. The day isn’t over yet, but it bounced, and has started to recover. Nowhere close to erasing yesterday’s move, but no longer looking so much like a free fall. We’ll see… There’s always tomorrow. Or later today. But either way, it struck me as a good time to revisit the Investor Emotion Cycle (chart). When everybody starts thinking the same way, look out.

It can be tough to evaluate your own circumstances when the targets are moving this quickly. But if we’ve seen the bottom in rates, and are in fact headed to a new range, it’s going to stir up quite a few issues for people with adjustable rates, or who had been waiting for something else to fall into place. Sound like you? Let’s talk about it. Contact me below, and let me know what’s up.

Thinkin About Today’s Payroll Data

I find it interesting that the payroll data is regarded as good news today when A) it came in below expectations and B) new jobs created were barely enough to cover population growth, let alone make a dent in the unemployment glut. The government’s forecasts for recovery require job creation 2x the historical average over nearly a full 10 years just to get unemployment back to healthy levels. And this is while surging productivity gains is helping business grow without hiring new help…

Sorry, not good news for the economy.

PS – the best thing about having a bearish sentiment on such matters is that you’re either right, or the news is pleasant surprise. win/win! (I’d love to see some REAL good news in this data, but unfortunately I don’t think this comes close)

Sincerely,

Armchair Economist

California Home Buyer Tax Credits – New Construction AND First Time Buyer – DETAILS

Tax Credit Reference Sheet

California Assembly Bill 183

Background

- Part of the Governor’s big Jobs Initiative. This is his #1 priority. Credit for new construction stimulates job creation/preservation, and credit for first time buyers stimulates homeownership.

- Total Availability of funds is $100 Million for new construction AND $100 Million for first-time buyers

Terms

- Lesser of 5% or $10,000k (200k min purchase to maximize claim)

- Must enter contract between May 1-Dec 31 2010

- Credit is received over 3 years, equal installments

Eligibility

- Purchase new construction property OR

- Purchase existing property as a first-time buyer

- First Time Buyer is still defined as having not owned residence for the three years preceding purchase

- If married, filing separately, split allocations

- If unmarried, purchasing together, split according to ownership stake in property

Restrictions

- No income restrictions

- Cannot be a dependent on somebody else’s tax filing

- Cannot purchase from a relative *

- Cannot be under the age of 18

- Cannot have received CA home buyer tax credit from 2009

- 2 year recapture

- If first time-buyer AND new const – new const allocation overrides

Procedures

- Reserve credit by contacting Franchise Tax Board with notice that a contract has been signed (not required)

- Follow-up with FTB within 2 weeks of closing with:

- Settlement statement and cert by seller of non-occupancy (new const)

- Settlement statement and cert by buyer that they are first time buyer

If you have questions about how this might affect your plans to buy or sell a home in California, please email me

* Internal Revenue Code for Family (IRC 267 section (c)(4):

(4) The family of an individual shall include only his brothers and sisters (whether by the whole or half blood), spouse, ancestors, and lineal descendants

*** Please consult with your tax professional for advice specific to your situation!

4 Reasons Why Mortgage Rates Won’t Rise When The Fed Stops Buying

Back in November 2008, Mortgage Bonds (MBS) skyrocketed on the announcement by the Federal Reserve that the New York branch would allocate $750BN in funds for purchasing bonds. It was part of the overall stimulus effort – if you’ll remember, at the time, the markets were on the precipice of full-blown panic.

Later on, the program was expanded and extended, pushing the overall budget up to $1.25TN and the deadline out to March 29, 2010. That’s 2 weeks away.

When Mortgage Bonds go up in price, mortgage rates come down. That’s just the way it is. Same is true with all bond investments.

If you read much financial news, or real estate news, you’re probably seeing a lot of commentary about this campaign by the Fed, and also the impending end point of the program. There’s two weeks left. And most of the stories that talk about this are speculating that the removal of the Fed’s checkbook from the bond pits is going to cause mortgage rates to rise anywhere from .500% to 1.500%. The concern of course being that this steps on the toes of the fringe of qualified buyers, takes demand out of the market for housing, and therefore puts a wet blanket on current housing market recovery efforts.

One thing about me is, I like to go against the grain a bit. I’m not so sure this is as big a deal as the news is making it out to be. Here are four reasons why:

- The markets are not really reacting yet. When an event is anticipated in the market, the market starts to make that expectation a reality before it is a reality. If rates were going to go to 6.5%, they’d be well on their way right now. And they’re not. In fact, we’ve seen rates trending down for most of the past month.

- This event is a massive experiment with no historical standard. Anybody who gives a number that interest rates – or any market security – are going to is purely speculating.

- Rates were around 6% when this program came online, and we dropped to 4.500 – 5.000% almost instantly. You can see it on this chart. It’s easy to assume we will go back to 6.000% when it ends. But our general environment isn’t nearly the same as it was when the program started. Back then, the market was entering a panic, nobody wanted anything but cash, and mortgage investments were especially regarded as hot potatoes. Today, with the way they’ve cranked down on underwriting rules, mortgage debt is a pretty solid investment, and I think with the Fed leaves, we’ll see more private support than journalists are expecting.

-

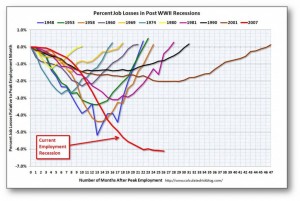

Job losses during recession; current compared to past - click to enlarge Plus, check out this chart on unemployment. It’s a pretty powerful representation of where we are in this recovery. We still have a long way to go. If there really isn’t private money ready to buy mortgage debt once the Fed leaves the market, we may see the Fed to revisit the program. Maybe it takes a while; they held their line firm at yesterday’s policy meeting. But they’re not about to let rates run up any time soon. It would be too devastating to this economy.

Every time the Fed gets a chance to affirm that they’re departing the market at the end of March, the markets get another chance to consider whether or not it’s a bluff. And as that date draws nearer, the stakes get bigger. So far, the market has affirmed it’s reaction of “We don’t care.” / “We don’t believe you.”. But it’s tough to tell which sentiment is more pertinent.

When the the $1.25TN is spent, and the Fed packs their bags, we’ll be able to see who’s stepping up to fill the void. In the meantime, if I was planning to buy or sell a home, I don’t think I’d hesitate for a second and consider calling the bluff of the Federal Reserve in the biggest game ever played in our marketplace.

The Top Five Market Factors That Influence Mortgage Rates

For a consumer to find quick access to accurate mortgage rate data, it can be a challenge. This isn’t because the mortgage industry is unwilling to share information; it’s because there are at least 50 variables in the equation between “what’s the rate?” and a valid answer. Anybody providing an answer without digesting those variables is either wishfully thinking, or lying through their teeth.

But outside of the consumer’s control, the marketplace where mortgage rates are determined is a dynamic, volatile, living and breathing animal. Lenders set their rates every day based on the market activities of Mortgage Bonds, also know as Mortgage Backed Securities (MBS), which trade in bond markets on a daily basis.

On volatile days, a lender might adjust their pricing anywhere from one to five times, depending on what’s taking place in the market.

Below are the five most important market categories affecting MBS prices right now:

for more information on what exactly Mortgage Backed Securities are, you can get a face-full at wikipedia, or take me out for a cup of coffee.

1. Inflation – As inflation increases, or as the expectation of future inflation increases, rates will push higher. The contrary is also true; when inflation declines, rates decrease.

Famous economist Milton Friedman said “inflation is always and everywhere a monetary phenomenon”. Public Enemy #1 of all fixed income investments, inflation and the expectation of future inflation is a key indicator of how much investors will pay for mortgage bonds, and therefore how high or low current mortgage rates will be in the open market.

When an investor buys a bond, they receive a fixed percentage of the value of that bond as ‘coupon’ payments. With MBS, an investor might buy a bond that pays 5.000%, which means for every $100 invested, they receive $5 in interest per year, usually divided up over 12 payments.

Do your parents ever tell you about how they used to go see two movies and get a bag of popcorn all for $0.25? (just mine??). A movie ticket today in the San Francisco Bay Area costs anywhere from $10-$12, and don’t even get me started on the price of movie theater popcorn! That my friends, is inflation.

For the buyer of a mortgage bond, that $5 coupon payment is worth more in the first year, because it can buy more today than it can in the future, due of inflation (‘always and everywhere…’). So when the markets read signals of increasing inflation, it tells bond investors that their future coupon payments will be less valuable by the time they receive them. And this causes investors to demand higher rates for any new bonds they invest in.

As the government looks for resource to finance economic stimulus, war, and everything else that has the budget lopsided, there have been auctions of US Treasury bonds and notes that are record in size. It is important to recognize that the size of these obligations raise the risk of future inflation, however, bursting bubbles in credit markets and in housing are immensely deflationary, meaning, they work against inflation. The world is in the process of deleveraging, which is to say we are all trying to pare down the amount of credit we have relative to our assets. There’s no significant inflation anywhere in sight.

2. The Federal Reserve – as part of the ongoing stimulus effort, the NY Fed has spent almost all of its $1.25TN budget for buying mortgage bonds, which has ‘artificially’ pressed down on mortgage rates over the past 15 months. When they’re done, it’s anybody’s guess.

You don’t have to look too hard to find somebody who will tell you that as soon as the Fed terminates this MBS buying program, mortgage rates are going to jump by anywhere between .500% and 1.500%.

I’m not so sure.

I think a better prediction is ‘who the heck knows?’. This campaign – which ran at about $5BN in purchases every day during its height, and which happened to exceed the daily production of new mortgage lending by almost 100% – is a MAJOR experiment. There is simply no precedent for it whatsoever. The Fed has been mopping up the crime scene after a bloody massacre in the mortgage lending sector. We don’t yet know what it’s going to look like when they pack up and go home. So if anybody tells you that there’s an automatic adjust-to impact once it ends, they might just be regurgitating somebody else’s guess.

The key reason why I don’t like guessing at the impact of the Fed’s absence (oh, by the way, they’re gone as of March 29, unless an extension to the program gets announced) is because the environment when this program was announced was drastically different than the one we are in now. When the program was announced back in November 2008, mortgage bonds reacted immediately, and dramatically. But at that time, nobody else wanted to buy mortgage bonds. They were the hot potato of the investment world as we faced a massive panic about a meltdown in the mortgage market pulling the entire world economy into chaos.

Today, that’s no longer the case. Loan underwriting guidelines have been significantly revised, and banks are not making the same careless or risky investments as they were a few years ago. Therefore, the appeal of mortgage bonds as an investment is entirely different than it was in Nov 2008.

In short, I don’t think the impact of the Fed leaving will be as big as people are saying. If it was going to be, the markets would already be adjusting to that reality, which is a mere two weeks away. Either that, or the markets don’t actually believe the Fed is going to terminate this program, but that’s a topic for another day.

3. Unemployment – Decreasing unemployment will suggest that mortgage rates are to rise.

Here’s a great visual aid to see how unemployment rates have trended over time in all states:

Right now, the unemployment rate is at 9.7%, just slightly below it’s highest mark in the current economic cycle. Every month, the BLS releases the Nonfarm Payrolls, aka The Jobs Report, which tallies the number of jobs created or lost in the preceding month. The last report indicated a loss of 36,000 jobs. Not necessarily a number that will move the needle on the unemployment gauge but some economists suggest we need about 125,000 new jobs each month just to keep pace with population growth. So that -36,000 is more like -161,000 jobs short of an improving unemployment picture.

The reason the unemployment rate has not climbed in the last few months is more a function of survey methodology than real economic recovery. The measure fails to capture part-time workers who desire full time employment, discouraged job seekers who have taken time off from searching, and other would-be workers who are not considered to be part of the labor force.

4. GDP – High levels of GDP growth will signal increasing mortgage rates.

We’re currently building on two consecutive quarters of positive GDP growth. Five of the six preceding quarters were negative – the so-called “Great Recession”. GDP, or Gross Domestic Product, is a measure of the economic output of the country.

The Federal Reserve slashes rates when GDP slows, to encourage people and business to borrow money to spend on all the things that get measured in GDP. When GDP gets too hot, there might be too much money floating around, and inflation usually picks up. So high GDP ratings warn the market that interest rates will rise to keep things in balance.

Mortgage bonds are currently on the edge of their seat to see confirmation of a recovering economy, and rates will rise when the news is convincing enough. The last GDP reading (+5.9% from the previous period) was a huge jump. But similar to the case with unemployment above, there’s more to the story than just the headline.

Spiking GDP with flat/increasing unemployment begs some questions. There are two major indicators that help provide more context.

- increases to worker productivity – employers are getting more work out of their current employees to avoid hiring new ones, and

- surges in inventory cycles – when the economy first started contracting, manufacturing slowed down to cut costs, and sales were made by liquidating inventory. This is like a roller coaster cresting a hill, where one part of the train is going up, the other down. Eventually, the other side catches up, inventories are rebuilt by manufacturing more than is being sold. Both surges can throw off periodic reports of GDP.

5. Geopolitics – Unforeseen events related to global conflict, political events, and natural disasters will tend to lower mortgage relates.

Anything that the markets didn’t see coming causes uncertainty and panic. And when markets panic, money generally moves to stable investments, such as bonds, which brings rates lower. Mortgage bonds pick up some of that momentum. Acts of terrorism, tsunami‘s and earthquakes, and recent sovereign debt crises (Dubai, Greece) are all examples.

How do you tie it all together?

Economic data is reported daily, and some items have a greater tendency to be of concern to the market for mortgage rates. If you are involved in a real estate financing transaction, it’s helpful to be aware of these influences, or to rely upon the advice of a mortgage professional who is already dialed in.

How To ‘Greece’ A Credit Crisis

I love the parable offered by David Kotok at Cumberland Advisors in a recent market commentary, a link to which you will find below.

“My Big, Fat, Never on Sundays Story.”

It is the month of February, on the shores of the Adriatic Sea. It is gray and raining. The little Greek town looks totally deserted.

It has been many months of tough times; everybody is in debt and everybody lives on credit. The government has run out of money and the unions are constantly striking but getting nothing because there is nothing left to be gotten.

Suddenly, a rich German tourist comes to the village. He enters the town’s only hotel, lays a 100 euro note on the reception counter, and goes upstairs to inspect the rooms in order to pick one.

The hotel proprietor takes the 100 euro note and runs to pay his debt to the butcher.

The butcher takes the 100 euro note and runs to pay his debt to the pig grower.

The pig grower takes the 100 euro note and runs to pay his debt to the supplier of his feed and fuel.

The supplier of feed and fuel takes the 100 euro note and runs to pay his debt to the town’s prostitute, who, in these hard times, provided her services on credit.

She runs to the hotel to pay for the rooms she rented on credit when she brought her clients there. She hands the proprietor the 100 euro note.

He lays the note back on the reception counter so that the rich tourist will not suspect anything.

A minute later, the wealthy German comes down the stairs, announces he did not like any of the rooms, puts the 100 in his pocket, gets into his Mercedes, and drives away.

There were six financial transactions. No one earned anything. Nothing was added to GDP. However, the whole town’s debt-GDP ratio changed dramatically. The village folks are now out of debt and look to the future with a lot of optimism.

Oh, if it were only so easy?

You can see more context to this in the commentary piece, and also other fantastic coverage of the sovereign debt issues, and whatever else may be going on in the market at the given moment at the Cumberland Advisors website.