Thanks for stopping by - This is a work in progress, so please feel free to jump in with me - any comments, feedback, or participation in the conversation is encouraged! You might want to want to sign up for email updates on the right, or subscribe to my RSS feed. Thanks for visiting!

Glad to have you back - have you considered signing up for email updates on the right, or subscribing to my RSS feed? Thanks for visiting!

For a consumer to find quick access to accurate mortgage rate data, it can be a challenge. This isn’t because the mortgage industry is unwilling to share information; it’s because there are at least 50 variables in the equation between “what’s the rate?” and a valid answer. Anybody providing an answer without digesting those variables is either wishfully thinking, or lying through their teeth.

But outside of the consumer’s control, the marketplace where mortgage rates are determined is a dynamic, volatile, living and breathing animal. Lenders set their rates every day based on the market activities of Mortgage Bonds, also know as Mortgage Backed Securities (MBS), which trade in bond markets on a daily basis.

On volatile days, a lender might adjust their pricing anywhere from one to five times, depending on what’s taking place in the market.

Below are the five most important market categories affecting MBS prices right now:

for more information on what exactly Mortgage Backed Securities are, you can get a face-full at wikipedia, or take me out for a cup of coffee.

1. Inflation – As inflation increases, or as the expectation of future inflation increases, rates will push higher. The contrary is also true; when inflation declines, rates decrease.

Famous economist Milton Friedman said “inflation is always and everywhere a monetary phenomenon”. Public Enemy #1 of all fixed income investments, inflation and the expectation of future inflation is a key indicator of how much investors will pay for mortgage bonds, and therefore how high or low current mortgage rates will be in the open market.

When an investor buys a bond, they receive a fixed percentage of the value of that bond as ‘coupon’ payments. With MBS, an investor might buy a bond that pays 5.000%, which means for every $100 invested, they receive $5 in interest per year, usually divided up over 12 payments.

Do your parents ever tell you about how they used to go see two movies and get a bag of popcorn all for $0.25? (just mine??). A movie ticket today in the San Francisco Bay Area costs anywhere from $10-$12, and don’t even get me started on the price of movie theater popcorn! That my friends, is inflation.

For the buyer of a mortgage bond, that $5 coupon payment is worth more in the first year, because it can buy more today than it can in the future, due of inflation (‘always and everywhere…’). So when the markets read signals of increasing inflation, it tells bond investors that their future coupon payments will be less valuable by the time they receive them. And this causes investors to demand higher rates for any new bonds they invest in.

As the government looks for resource to finance economic stimulus, war, and everything else that has the budget lopsided, there have been auctions of US Treasury bonds and notes that are record in size. It is important to recognize that the size of these obligations raise the risk of future inflation, however, bursting bubbles in credit markets and in housing are immensely deflationary, meaning, they work against inflation. The world is in the process of deleveraging, which is to say we are all trying to pare down the amount of credit we have relative to our assets. There’s no significant inflation anywhere in sight.

2. The Federal Reserve – as part of the ongoing stimulus effort, the NY Fed has spent almost all of its $1.25TN budget for buying mortgage bonds, which has ‘artificially’ pressed down on mortgage rates over the past 15 months. When they’re done, it’s anybody’s guess.

You don’t have to look too hard to find somebody who will tell you that as soon as the Fed terminates this MBS buying program, mortgage rates are going to jump by anywhere between .500% and 1.500%.

I’m not so sure.

I think a better prediction is ‘who the heck knows?’. This campaign – which ran at about $5BN in purchases every day during its height, and which happened to exceed the daily production of new mortgage lending by almost 100% – is a MAJOR experiment. There is simply no precedent for it whatsoever. The Fed has been mopping up the crime scene after a bloody massacre in the mortgage lending sector. We don’t yet know what it’s going to look like when they pack up and go home. So if anybody tells you that there’s an automatic adjust-to impact once it ends, they might just be regurgitating somebody else’s guess.

The key reason why I don’t like guessing at the impact of the Fed’s absence (oh, by the way, they’re gone as of March 29, unless an extension to the program gets announced) is because the environment when this program was announced was drastically different than the one we are in now. When the program was announced back in November 2008, mortgage bonds reacted immediately, and dramatically. But at that time, nobody else wanted to buy mortgage bonds. They were the hot potato of the investment world as we faced a massive panic about a meltdown in the mortgage market pulling the entire world economy into chaos.

Today, that’s no longer the case. Loan underwriting guidelines have been significantly revised, and banks are not making the same careless or risky investments as they were a few years ago. Therefore, the appeal of mortgage bonds as an investment is entirely different than it was in Nov 2008.

In short, I don’t think the impact of the Fed leaving will be as big as people are saying. If it was going to be, the markets would already be adjusting to that reality, which is a mere two weeks away. Either that, or the markets don’t actually believe the Fed is going to terminate this program, but that’s a topic for another day.

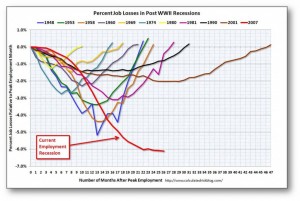

3. Unemployment – Decreasing unemployment will suggest that mortgage rates are to rise.

Here’s a great visual aid to see how unemployment rates have trended over time in all states:

Right now, the unemployment rate is at 9.7%, just slightly below it’s highest mark in the current economic cycle. Every month, the BLS releases the Nonfarm Payrolls, aka The Jobs Report, which tallies the number of jobs created or lost in the preceding month. The last report indicated a loss of 36,000 jobs. Not necessarily a number that will move the needle on the unemployment gauge but some economists suggest we need about 125,000 new jobs each month just to keep pace with population growth. So that -36,000 is more like -161,000 jobs short of an improving unemployment picture.

The reason the unemployment rate has not climbed in the last few months is more a function of survey methodology than real economic recovery. The measure fails to capture part-time workers who desire full time employment, discouraged job seekers who have taken time off from searching, and other would-be workers who are not considered to be part of the labor force.

4. GDP – High levels of GDP growth will signal increasing mortgage rates.

We’re currently building on two consecutive quarters of positive GDP growth. Five of the six preceding quarters were negative – the so-called “Great Recession”. GDP, or Gross Domestic Product, is a measure of the economic output of the country.

The Federal Reserve slashes rates when GDP slows, to encourage people and business to borrow money to spend on all the things that get measured in GDP. When GDP gets too hot, there might be too much money floating around, and inflation usually picks up. So high GDP ratings warn the market that interest rates will rise to keep things in balance.

Mortgage bonds are currently on the edge of their seat to see confirmation of a recovering economy, and rates will rise when the news is convincing enough. The last GDP reading (+5.9% from the previous period) was a huge jump. But similar to the case with unemployment above, there’s more to the story than just the headline.

Spiking GDP with flat/increasing unemployment begs some questions. There are two major indicators that help provide more context.

- increases to worker productivity – employers are getting more work out of their current employees to avoid hiring new ones, and

- surges in inventory cycles – when the economy first started contracting, manufacturing slowed down to cut costs, and sales were made by liquidating inventory. This is like a roller coaster cresting a hill, where one part of the train is going up, the other down. Eventually, the other side catches up, inventories are rebuilt by manufacturing more than is being sold. Both surges can throw off periodic reports of GDP.

5. Geopolitics – Unforeseen events related to global conflict, political events, and natural disasters will tend to lower mortgage relates.

Anything that the markets didn’t see coming causes uncertainty and panic. And when markets panic, money generally moves to stable investments, such as bonds, which brings rates lower. Mortgage bonds pick up some of that momentum. Acts of terrorism, tsunami‘s and earthquakes, and recent sovereign debt crises (Dubai, Greece) are all examples.

How do you tie it all together?

Economic data is reported daily, and some items have a greater tendency to be of concern to the market for mortgage rates. If you are involved in a real estate financing transaction, it’s helpful to be aware of these influences, or to rely upon the advice of a mortgage professional who is already dialed in.