How often do mortgage rates change these days?

About every 3.1 hours.

I’ll admit, July seemed to be a lot more volatile than a review of the tape is indicating. Perhaps that’s because most of the turbulence was in the last week of the month. We had an abysmal GDP report last week, and then of course the craziness over the debt ceiling and budget debates. On the final day of July, mortgage bonds – the instruments that loan originators monitor to keep a pulse on rate movement – wound up at their best levels of the month. In fact, it was their best level of the year.

Mortgage rates still have some catching up to do, as Friday’s move was so sudden and far, that the lenders seemed to have trouble keeping pace with the momentum. That’s typical when rates should be improving – not when they’re going up. “Up like a rocket, down like a feather” (I have no idea who said that first, but that’s how it plays out).

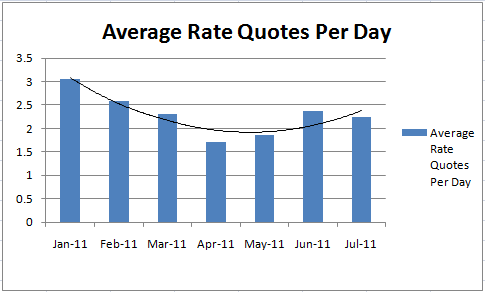

In July, on average, rates changed 2.25 times per day.

Technically, volatility was down slightly from June. But the number of rate changes does not tell you the whole story. Some of the rate changes were bigger than others, and in July, we had some big overnight moves. To conclude that July was less volatile than June would be misguided.

Rates Changed 45 Times During the 20 Trading Days in July

If you had a 30 day escrow during the month of July, that means there were potentially 45 different pricing results that you could have obtained based just on the timing of your rate lock. The average duration of a rate sheet issued by lenders was about 3.1 hours. That is up from 3.0 hours hours in June.

What About this Debt Ceiling Issue?

There are some rules of thumb in the markets that are relevant here:

- Mortgage rates improve when bond investments are in favor.

- Mortgage bonds often follow the direction of Treasury notes.

- Bonds are often in favor when stocks are out of favor.

- Both markets hate uncertainty.

None of these is universal (well, maybe the last one). In the lead up to Sunday’s debt ceiling agreement, uncertainty had become ‘priced in’ to the market values of investment securities. This includes stocks and bonds. In many regards, we are in such uncharted territory with the economy, there’s no way to predict what will come next.

For example, economists in and out of the mortgage industry thought mortgage rates would jump in March of 2010 after the Federal Reserve ended Quantitative Easing. Instead, rates fell off the ledge and hit all-time lows within 3 months. The experts are all over the map, and more are wrong than right with this stuff.

As I write this on Sunday evening, the markets appear poised for a stock market rally (a fairly significant one) and a more mild bond market sell-off. This would be consistent with the last two bullet points above. It addresses the typical relationship between stocks and bonds. And with near-term uncertainty removed from the markets they are set to react.

Could this be a good thing for mortgage rates?

There are a few reasons why mortgage rates may not really care all that much about this right now. For one, at the core of the debate is the essence of our economy – it’s kind of the pits right now. That reality is going to keep rates low across the board for a while.

Two, I’m not sure anybody really thought this debate was anything more than a game of political chicken. Everyone knew what was on the line; nobody was going to let it break down fatally. If this stock market rally doesn’t gain traction over the next few days/weeks, that’s a sign that the ‘uncertainty factor’ wasn’t really all that real.

On the flip side of this, if there was true market anxiety over the debt ceiling issue, the traditional bond/stock lever wasn’t fully intact here. Nervous money moves from stocks to bonds, but panic money moves to the sidelines, away from both. To cash, hard assets, gold, etc. We may see some relief buying in both stocks and bonds, and that will also serve as a force helping keep rates down low.

One more facet of the “good for mortgage rates” argument is that the whole ordeal with the debt ceiling, and the threat of credit downgrades for the US has direct implications for Treasury securities. Mortgage bonds are a step removed from these instruments, and while they often move in a similar fashion, the markets were getting a nervous twitch about Treasury debt, not mortgage debt.

I am sure that I’m overlooking some key variables here. Perhaps guilty of wishful thinking. I guess we’re about to find out…

How to Make the Most of it

If you speak to someone who suggests they can get you the perfect lock, that’s probably a bad sign. Market prediction on that level is impossible. Especially in the face of a market in as unique a place as ours is right now.

Similarly, you shouldn’t expect to catch the market at it’s absolute low – it’s not a realistic expectation. But a professional who can explain the market context you’re transacting in, and show you which calendared events have potential to introduce risk or opportunity to your strategy, is probably more valuable as a resource than anything else when trying to maximize your rate lock.

Make sure you get your rate quotes in the same vintage. This means that any lender who isn’t quick to reply to your inquiry isn’t really helping out. Then, make sure your lender is tuned in to the economic calendar, so that you can be aware of what days are more or less likely to be volatile ones. The market gets little economic data points or events to digest just about every day. It’s important to know which ones carry greater risk at any given time, as their significance can change with the greater context of the marketplace. The last thing you want to do is leave your rate lock open when the risk is greater than the potential reward.

Working with your lender to create a lock and pricing strategy suitable for your transaction will probably shed some light on who you’re working with, and serve you far better in the long run than comparing apples and gooseberries.

Need help with a rate lock strategy? Contact me below and tell me how I can help.