A big number popped out at me in this headline: Miami-Dade County Pending Home Sales Jump 25%

Pending Home Sales is a relatively new metric and is slightly different from the Existing Home Sales data. The key difference is that Pending sales have signed contracts, but the transactions have not yet closed.

So as a way of monitoring sales data, it’s a bit soft. But as a single data point, it is headline worthy – especially for the Miami market, which experienced one of the worst drubbings in the housing collapse over the past few years.

Real estate markets are very local. We cannot assume that what happens in Miami will happen to Bay Area housing at the same time. But there is no doubt that the general market has been a bubble in the process of bursting. Some hyper-local markets have been resilient, but for the most part this has been a national phenomenon.

The bottom cannot be identified until it has already happened. The period marked by uncertainty, conflicting data, wavering moods often signifies that we’re in the bottom.

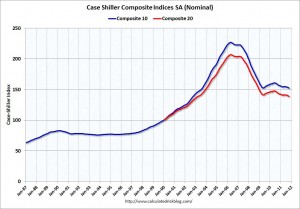

For most markets, housing value free fall ended somewhere in the first half of 2009, as noted in the broad Case-Shiller index.

Since then there has been a steady run of reports, specific to housing, and on the broader economy, that fuel the debate about what’s next for housing:

- double dip / 2nd down leg

- slow grind lower

- stagnate

- bounce back somewhat

The mood has wavered with the data. The index has also seesawed with the steady drip of economic reports. The debate will continue to rage onward in 2012, but we’re starting to see more and more comments and data in favor of housing going forward.

- home builder sentiment is rising

- rent vs. own math is equalizing, if not inverted

- investment capital is seeking real estate investment

- all-cash real estate purchases are at an all-time high, evidence of demand despite banking/lending dysfunction

The Housing Markets Hit the Hardest Have The Most To Re-gain

There was a bubble, and then there were some out of control markets. Fringe development areas built on the promise of new community infrastructure are not likely to have a quick value bounce. But metropolitan areas, with nearby access to jobs, schools, existing communities will become desirable markets again.

Once overbuilt markets like Miami will, in recovery, catch the attention of other areas, and influence the mood just as they did on the way down.

It will be important to find other data points trending in the same direction, or showing the same sentiment as confirmation that this is a meaningful reference. There are a lot of tentative buyers on the sidelines waiting to confirm the market has bottomed. Recovery may be gradual, but could have quick lurches forward as the sentiment can shift quickly.

Check out the rent vs. own math for your own scenario for free