Thanks for stopping by - This is a work in progress, so please feel free to jump in with me - any comments, feedback, or participation in the conversation is encouraged! You might want to want to sign up for email updates on the right, or subscribe to my RSS feed. Thanks for visiting!

Glad to have you back - have you considered signing up for email updates on the right, or subscribing to my RSS feed? Thanks for visiting!

How often do mortgage rates change?

About every three hours.

Mortgage rate volatility jumped in June, after a few relatively calm months. That isn’t helping people shop for loans, since it makes it very difficult to compare options. If you survey a few different lenders, and it takes all day to get quotes, you may be looking at indications from different rate ‘vintages’.

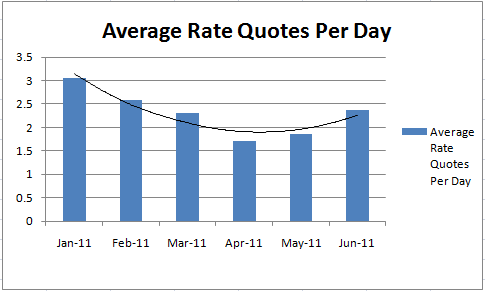

In June, on average, rates changed almost two and a half times per day.

Rates changed 52 times during the 22 bond trading days in June.

If you had a 30 day escrow during the month of June, that means there were 52 different pricing results that you could have obtained based just on the timing of your rate lock. The average duration of a rate sheet issued by lenders was about 3.0 hours. That is down from 3.8 hours hours in May.

Volatility Came From Events Not On The Economic Calendar

During the months of April and May, when mortgage rate volatility calmed a bit, there was also a growing sense of optimism in much of the economic data that was trickling in. The signals were not exactly what you’d expect with a booming economy, but after the slow recovery crawl we’ve been enduring for the last 2 years (The Great Recession was officially declared over July 2009), ‘less bad’ news begins to sound great. And that’s what April and May brought. Less bad news. Something to grasp onto for the optimists.

But the slow motion train wreck in the Euro Zone came to the surface again in June, with the uncertainty about Greek debt default, associated debates and protests about austerity measures, and concerns about a potential spillover into other European nations, not to mention a scramble to quantify direct US exposure. These issues are not on the official economic calendar. Even though there is an awareness of the issue, the outlook has been highly uncertain, and the markets have reacted swiftly to each and every signal. Some good, some bad. Rates up, rates down. Volatility defined.

How to Make the Most of it

If you speak to someone who suggests they can get you the perfect lock, that’s probably a bad sign. Market prediction on that level is impossible. Similarly, you shouldn’t expect to catch the market at it’s absolute low – it’s not a realistic expectation. But a professional who can explain the market context you’re transacting in, and show you which calendared events have potential to introduce risk or opportunity to your strategy, is probably more valuable as a resource than anything else when trying to maximize your rate lock.

Make sure you get your rate quotes in the same vintage. This means that any lender who isn’t quick to reply to your inquiry isn’t really helping out. Then, make sure your lender is tuned in to the economic calendar, so that you can be aware of what days are more or less likely to be volatile ones. The market gets little economic data points or events to digest just about every day. It’s important to know which ones carry greater risk at any given time, as their significance can change with the greater context of the marketplace. The last thing you want to do is leave your rate lock open when the risk is greater than the potential reward.

Working with your lender to create a lock and pricing strategy suitable for your transaction will probably shed some light on who you’re working with, and serve you far better in the long run than comparing apples and gooseberries.

Need help with a rate lock strategy? Contact me below and tell me how I can help.