Thanks for stopping by - This is a work in progress, so please feel free to jump in with me - any comments, feedback, or participation in the conversation is encouraged! You might want to want to sign up for email updates on the right, or subscribe to my RSS feed. Thanks for visiting!

Glad to have you back - have you considered signing up for email updates on the right, or subscribing to my RSS feed? Thanks for visiting!

Back in November 2008, Mortgage Bonds (MBS) skyrocketed on the announcement by the Federal Reserve that the New York branch would allocate $750BN in funds for purchasing bonds. It was part of the overall stimulus effort – if you’ll remember, at the time, the markets were on the precipice of full-blown panic.

Later on, the program was expanded and extended, pushing the overall budget up to $1.25TN and the deadline out to March 29, 2010. That’s 2 weeks away.

When Mortgage Bonds go up in price, mortgage rates come down. That’s just the way it is. Same is true with all bond investments.

If you read much financial news, or real estate news, you’re probably seeing a lot of commentary about this campaign by the Fed, and also the impending end point of the program. There’s two weeks left. And most of the stories that talk about this are speculating that the removal of the Fed’s checkbook from the bond pits is going to cause mortgage rates to rise anywhere from .500% to 1.500%. The concern of course being that this steps on the toes of the fringe of qualified buyers, takes demand out of the market for housing, and therefore puts a wet blanket on current housing market recovery efforts.

One thing about me is, I like to go against the grain a bit. I’m not so sure this is as big a deal as the news is making it out to be. Here are four reasons why:

- The markets are not really reacting yet. When an event is anticipated in the market, the market starts to make that expectation a reality before it is a reality. If rates were going to go to 6.5%, they’d be well on their way right now. And they’re not. In fact, we’ve seen rates trending down for most of the past month.

- This event is a massive experiment with no historical standard. Anybody who gives a number that interest rates – or any market security – are going to is purely speculating.

- Rates were around 6% when this program came online, and we dropped to 4.500 – 5.000% almost instantly. You can see it on this chart. It’s easy to assume we will go back to 6.000% when it ends. But our general environment isn’t nearly the same as it was when the program started. Back then, the market was entering a panic, nobody wanted anything but cash, and mortgage investments were especially regarded as hot potatoes. Today, with the way they’ve cranked down on underwriting rules, mortgage debt is a pretty solid investment, and I think with the Fed leaves, we’ll see more private support than journalists are expecting.

-

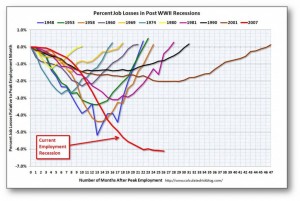

Job losses during recession; current compared to past - click to enlarge Plus, check out this chart on unemployment. It’s a pretty powerful representation of where we are in this recovery. We still have a long way to go. If there really isn’t private money ready to buy mortgage debt once the Fed leaves the market, we may see the Fed to revisit the program. Maybe it takes a while; they held their line firm at yesterday’s policy meeting. But they’re not about to let rates run up any time soon. It would be too devastating to this economy.

Every time the Fed gets a chance to affirm that they’re departing the market at the end of March, the markets get another chance to consider whether or not it’s a bluff. And as that date draws nearer, the stakes get bigger. So far, the market has affirmed it’s reaction of “We don’t care.” / “We don’t believe you.”. But it’s tough to tell which sentiment is more pertinent.

When the the $1.25TN is spent, and the Fed packs their bags, we’ll be able to see who’s stepping up to fill the void. In the meantime, if I was planning to buy or sell a home, I don’t think I’d hesitate for a second and consider calling the bluff of the Federal Reserve in the biggest game ever played in our marketplace.