No.

Where was I? Oh, Mortgage Rates…

There’s a lot of stuff floating around out there in the information superhighway. Sometimes, having a little information can lead to confusion or even disappointment when you try to use it to your advantage only to find out it wasn’t quite right in the first place.

What follows is a breakdown of the probable inputs that led up to this question above, and a comprehensive review of what’s really going on with mortgage rates. I may crack wise from time to time, but this post is not meant to be flippant. Part of my job here is to educate and inform, and this is an attempt to do just that. I figure many others are probably wondering the same kind of things, and well, it’s a jungle out there and all that…

The Feds are not in charge

First things first.”The Feds” do not change mortgage rates. And we’re all grateful for this. The Feds investigate crimes, flash badges, and sometimes look for little green men.

The Fed only sets the framework

“The Fed” also does not change mortgage rates. The Fed, or Federal Reserve does set Monetary Policy in the US. They meet every six weeks – or more if needed – to discuss policy, and formally release a policy statement at each meeting. One of the devices they use to set policy, which when changed, is often done so through this policy statement, is the Federal Funds rate. It sets the tone for all borrowing, but it does not correlate directly with mortgage rates. The Fed released their latest policy statement on Wednesday of this week, and there were no changes to the Federal Funds rate.

There was an announcement made at this Federal Reserve meeting about something unofficially called “Operation Twist“. This is a temporary program that is designed specifically to lower long term borrowing rates, including mortgages. But even still, The Fed does not set a specific rate. They have set a budget for buying instruments which influence rates – that’s as far as it goes.

Freddie Mac announces averages in a press release

Freddy Mac (not Feddy Mac, the Freddy, etc) issues a weekly mortgage rate survey every Thursday. The one that was released yesterday established a new record low on the average 30 year fixed rate mortgage. The rate in their headline this week was 3.66% (not 2.66%) which is indeed nice and low.

There are a few problems with Freddie Mac‘s number, though, if you’re shopping for mortgage rates and using that as a reference. All you can really with that number is get a relative sense, week to week, of what the market for mortgage rates is doing. The number in the headline is not your rate quote. Here are a few reasons why:

- The headline number is an average from the preceding few days. It’s old news by the time it gets released.

- The second paragraph of the press release highlights the cost to get the mortgage at that rate – this week an average of 0.7% points, or 7/10% of the amount being borrowed.

- The model scenario excludes condos, 2-4 unit buildings, vacation homes, investment properties, and loans above the national conforming limit of $417k

So if you’re in the market for a 2-unit investment property on a high-balance conforming loan, this number simply does not apply. But, if you watch the Freddie Mac survey each week, you’ll see the general trajectory of the market over time. If you want to get the most current rate information specific to your scenario, work with your lender or request a rate quote.

What We’re here for

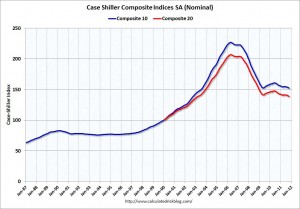

Making sense of the mortgage market can be really annoying frustrating. After a string of reports on Federal Reserve policy meetings, weekly mortgage rate surveys, and Operation Twist, it’s easy to see how somebody can connect the dots and think that the Fed just lowered rates to some crazy number. We haven’t even touched on the continuous drip of data related to existing home sales, new home sales, mortgage application volume, real estate price indexes, inflation, jobs, GDP and others! It’s a lot to keep up with!

If you don’t feel like you’re getting the information you need, or clear answers to your questions, you can always request a consultation.